How Life Insurance can Save You Time, Stress, and Money.

Table of ContentsExamine This Report about Life InsuranceGet This Report about Life InsuranceThe Main Principles Of Life Insurance The Main Principles Of Life Insurance Some Of Life InsuranceNot known Details About Life Insurance The Facts About Life Insurance RevealedThe Definitive Guide to Life Insurance

Life insurance policy is there to aid take some of the monetary concern off your enjoyed ones when you pass. It doesn't take lengthy to discover a life insurance coverage plan that will certainly meet your needs and also assist your family when they need it most.

The smart Trick of Life Insurance That Nobody is Discussing

Premiums as well as other policy qualities can vary by several elements including the quantity of coverage you require, as well as your age as well as wellness. If fatality occurs while the insurance coverage is active, your recipients can submit a case to obtain the payout.

"We usually advise people go for 10 to 15 times their revenue in life insurance policy," claims Nicholas Mancuso, senior procedures supervisor of Policygenius' advanced planning group. This quantity guarantees your beneficiaries are covered for the long-term. Because a life insurance benefit is a tax-free round figure of cash, your family members can use the cash money nonetheless they desire, consisting of: Real estate prices, consisting of paying off a home mortgage or paying rent, Other debts, like trainee finances, charge card or cars and truck settlements, Existing or future university education prices for your youngsters, Childcare Replacing financial backing you offered, Daily costs including food, transportation as well as medical care, Trip There are numerous sorts of life insurance policy, but term life insurance policy is the best selection for the majority of people because it is one of the most economical.

Little Known Facts About Life Insurance.

The benefits of a term life strategy consist of: The cheapest life insurance coverage you can buy. If you get term life insurance policy when you remain in your 20s, 30s, or 40s, you can lock in low rates.Term life insurance is totally an insurance policy product as well as doesn't have a savings or investment part. This is a good idea spending and minimizing your own yields greater returns.

One of the most apparent benefit of life insurance policy is the tax-free cash money payout for your enjoyed ones if you pass away. Economic defense is the most important possession life insurance coverage attends to you as well as your family members. Yet there are other significant benefits, depending upon the sort of life insurance coverage policy you buy as well as which added bikers you pick.

Little Known Facts About Life Insurance.

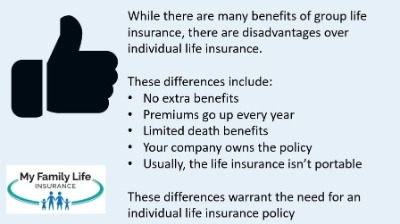

What are the pros as well as disadvantages of life insurance? The most significant advantage of life insurance coverage is additional info monetary security for your enjoyed ones if you die. You do have to pay month-to-month costs for this peace of mind, which can be expensive if you're in poor health or purchasing insurance coverage when you're older. life insurance.

: Individuals have come to be much more conscious of their wellness standing as well as have understood life insurance relevance and also advantages.

How Life Insurance can Save You Time, Stress, and Money.

Have you believed of spending your hard-earned cash and letting it expand as well as guaranteeing your household at the very same time? Having actually spent in a life insurance coverage plan gives you with dual chances of insuring your family and investing your cash in the market in shares, bonds, supplies, etc.

Consequently, one of one of the most essential aspects of life insurance significance is that it supplies a financial roof covering on your family members in case of any kind of regrettable incident and unclear times, such as the fatality of the household's income producer. In such instances, you would not need to fret if your household will encounter any financial restrictions in your absence.

The Best Guide To Life Insurance

In case of an unfortunate event of fatality of the capitalist, their household will get a swelling sum amount of cash in the kind of death benefits. Because of this, even if you are the sole income producer of your family members, you wouldn't have to worry about your family's financial requirements.

Another feature that adds to the importance of life insurance policy tax obligation benefits. Under area 80C of the Income Tax Obligation Act, 1961, the premium navigate to this website paid by the capitalist are eligible for tax benefits as much as Rs. 1. 5 lakhs each year. tax obligation regulations go through change every so often.

The Single Strategy To Use For Life Insurance

Numerous years ago, at our annual business banquet, we had a visitor speaker. She was a customer of Finity Team (and still is today).

Not known Incorrect Statements About Life Insurance

She had not been even sure how she was going to get with her maternity, allow alone lug on with life as a single mommy. Undoubtedly having life insurance policy wouldn't have brought her hubby back, however it would certainly have reduced some of the economic tensions she encountered throughout that time.